Boi Tax Form 2025. Filers can also view informational videos and webinars, find answers to frequently asked questions, connect to the contact center, and learn more about how to report at. Learn about mandatory beneficial ownership reporting in 2025.

Washington—the financial crimes enforcement network (fincen) issued a final rule today that extends the deadline for certain reporting companies to file their initial. Please refer to the applicable notice for specific information.

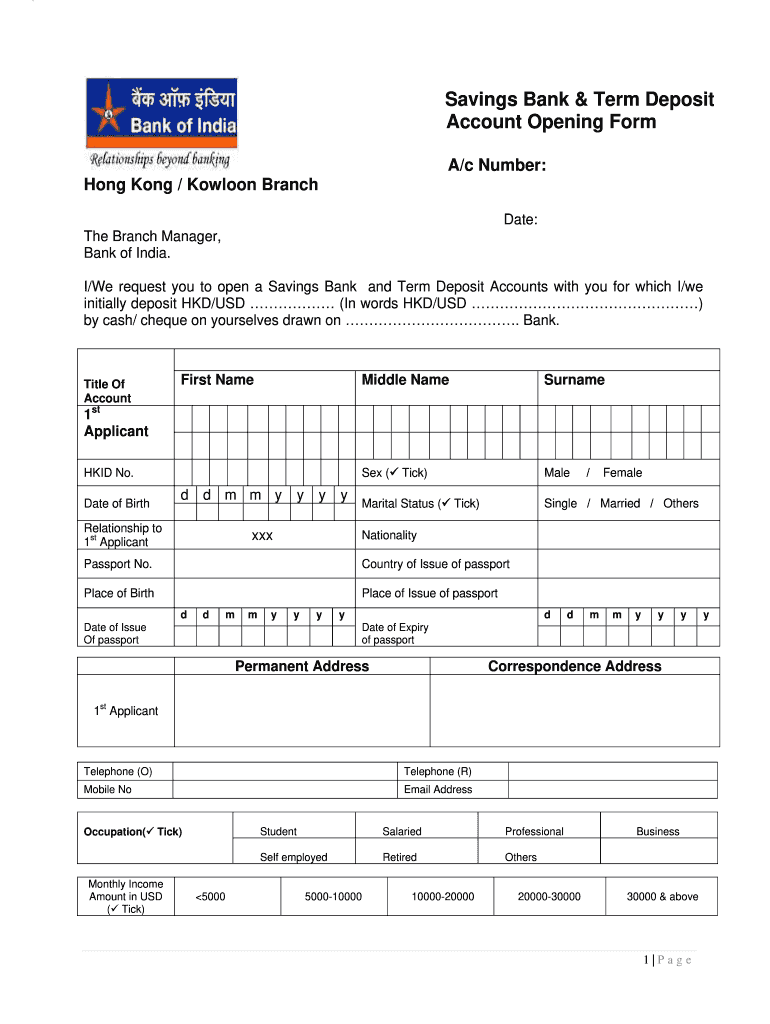

Boi form Fill out & sign online DocHub, Companies created in 2025 have 90 days from their creation date to file boi reports, while the deadline for companies created before 2025 is jan.

Are You Ready for the New 2025 Filing Requirements? FBAR & BOI, Filers can also view informational videos and webinars, find answers to frequently asked questions, connect to the contact center, and learn more about how to report at.

New Tax Filing Requirement Beneficial Ownership Information, The boi form came out of the passage of the corporate transparency act.

BOI Reporting Regulations Effective January 2025 Cherry Bekaert, 1, 2025, the cta requires corporations, limited liability companies (llcs), and other entities organized or registered to do business in the united states to file a.

boi neft form fillingboi neft rtgs formboi rtgs kaise karte haiboi, Since january 1, 2025, many companies are now required to report information about the individuals who own them, as a deterrent to financial crimes.

BOI Form 501_ Mfng Sector (REV).doc Cost Of Goods Sold Exports, Learn about mandatory beneficial ownership reporting in 2025.

2025 2025 Tax Form Printable Check Cyndi Karylin, 1, 2025, newly formed entities have 90 days from the date of receiving notice that the company’s creation or registration has become effective to file their boi report.

Tax rates for the 2025 year of assessment Just One Lap, There's a new form for companies to know about and file in 2025:

Boi Reporting 2025 Llc Form Rahel Carmelle, See who qualifies and reasons they should understand filing rules and exemptions.